Software for Banks and Credit Unions Who Want to Easily Build, Track, and Execute a Winning Strategy

The Ideal Software for Banks and Credit Unions Who Want to Improve Strategic Planning Processes

Guided Tools to Simplify Collaboration

Quickly Adapt to New/Lost Opportunities

Know Your Market to Build a Solid Strategy

Measure Progress and Foster Accountability

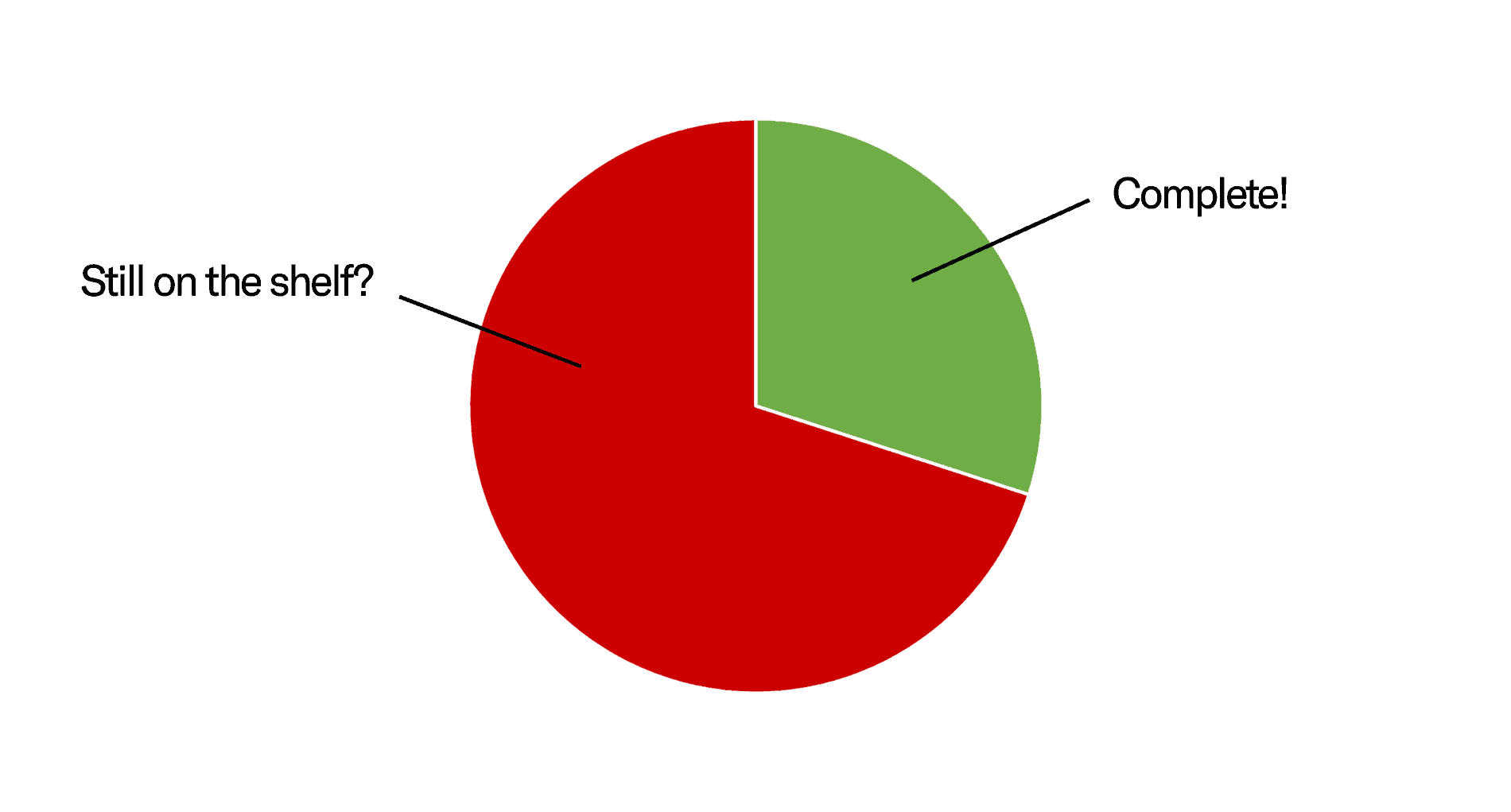

70% of Strategic Plans are never completed because most organizations don’t have the right tools to create an effective plan.

Where is your strategic plan?

StrategyGPS is a Cloud Based Software Solution Designed to Keep Your Team on Track

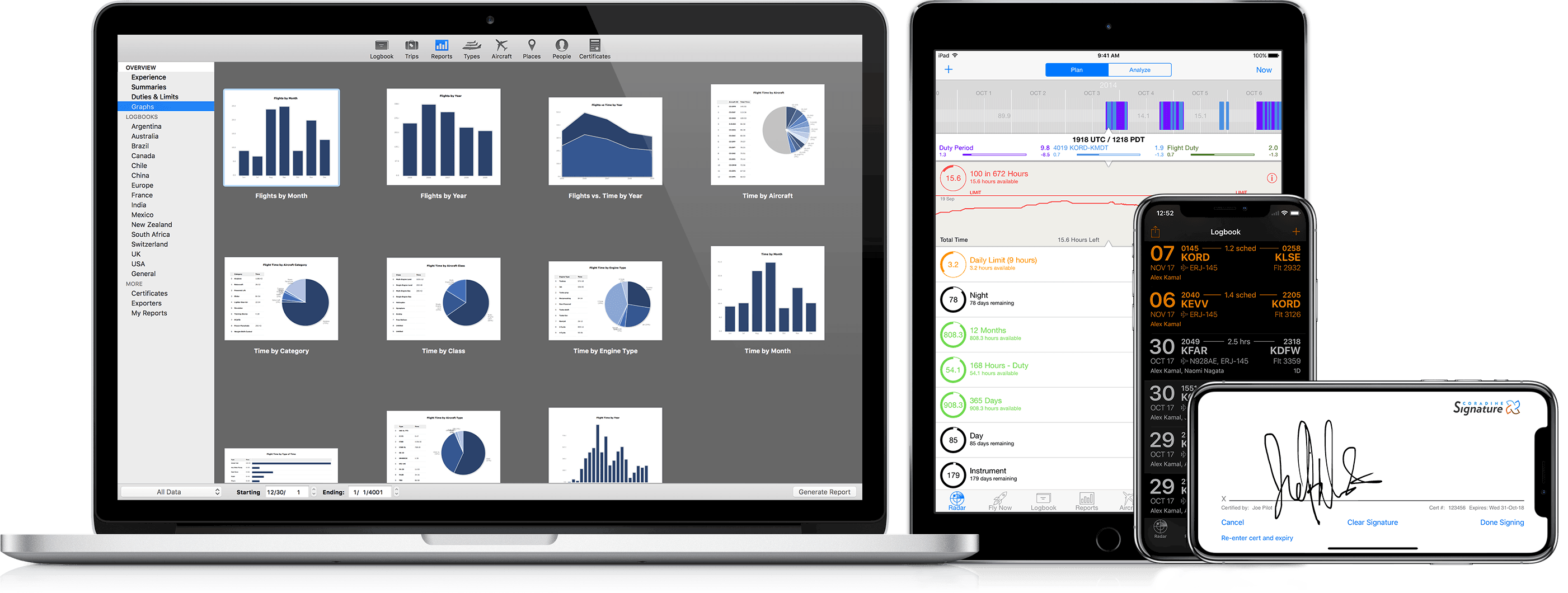

Collaborate

Don’t wait until the planning meeting to get started.

Collaborate to build your plan in StrategyGPS, finalize it during the session, and quickly and easily share ideas and status updates as you execute the plan.

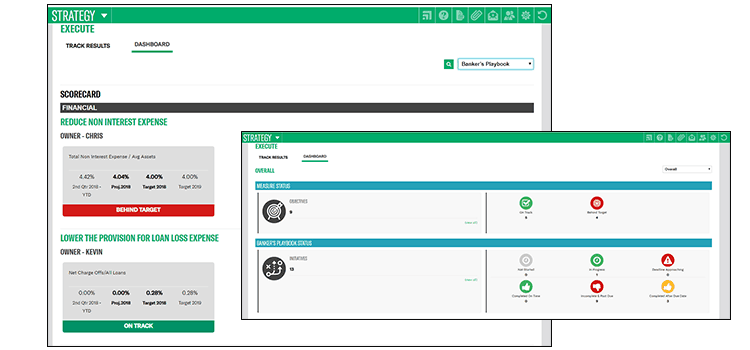

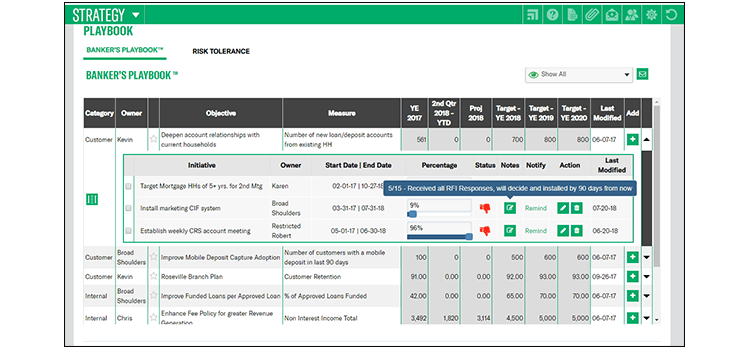

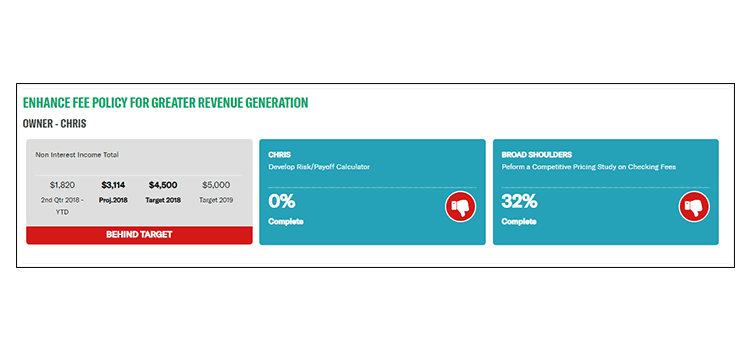

Execute

Whether you’re building a full strategic plan, market plan, or any other strategy; our system is built to help you drive execution on your objectives.

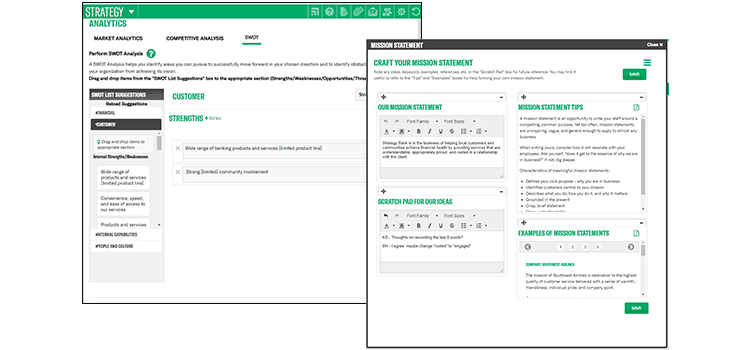

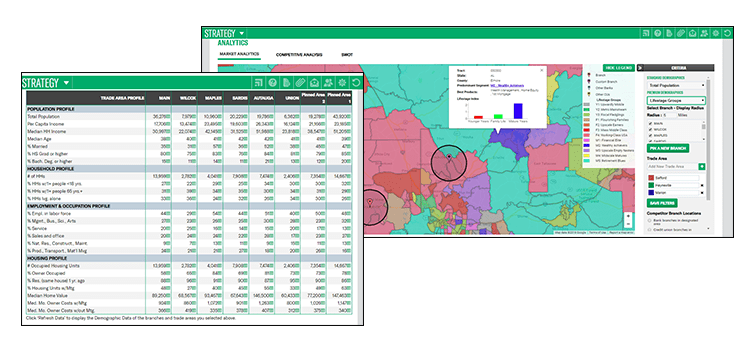

Analyze

Identify key growth areas based on market demographics, competitive metrics, and existing branch locations.

Evaluate the market potential for new products, services and delivery channels.

Stay on Track

Stay focused on execution with a living strategic playbook.

One-Click Access to update individual playbook, automate reminders, and update status in real time.

Foster Accountability and keep your team engaged.

Quickly Adapt

Numerous Action/Alert/Monitoring Tools in place to ensure one simple task does not disrupt the entire flow

Reprioritize objectives, modify initiatives, or add secondary goals quickly and easily.

Our clients love using StrategyGPS to move their plan off a spreadsheet and into action

Before we started using StrategyGPS, we managed our strategic plan with a spreadsheet. We had difficulty executing our plan and reporting progress to the board. Now, StrategyGPS is the tool by which we drive execution. It has made it much easier, not just in the initial development of the plan, but also in the follow-up, execution, and reporting to the board. It has made us so much more effective.

Ready to Build, Execute, and Track Your Winning Strategy?

Getting Started is Easy!

Receive a Personalized Demo

Start Using StrategyGPS

Execute Your Strategic Initiatives

Get Your Complimentary Strategic Profile

Don’t miss out on opportunities for your organization to grow and serve more clients. Find out how much you could accomplish with a free Strategic Profile from Plansmith

Products

Contact

1827 Walden Office Square, Ste. 350

Schaumburg IL 60173

Toll Free: 1.800.323.3281

Local: 1.847.359.4045

Fax: 1.847.705.8200

info@plansmith.com