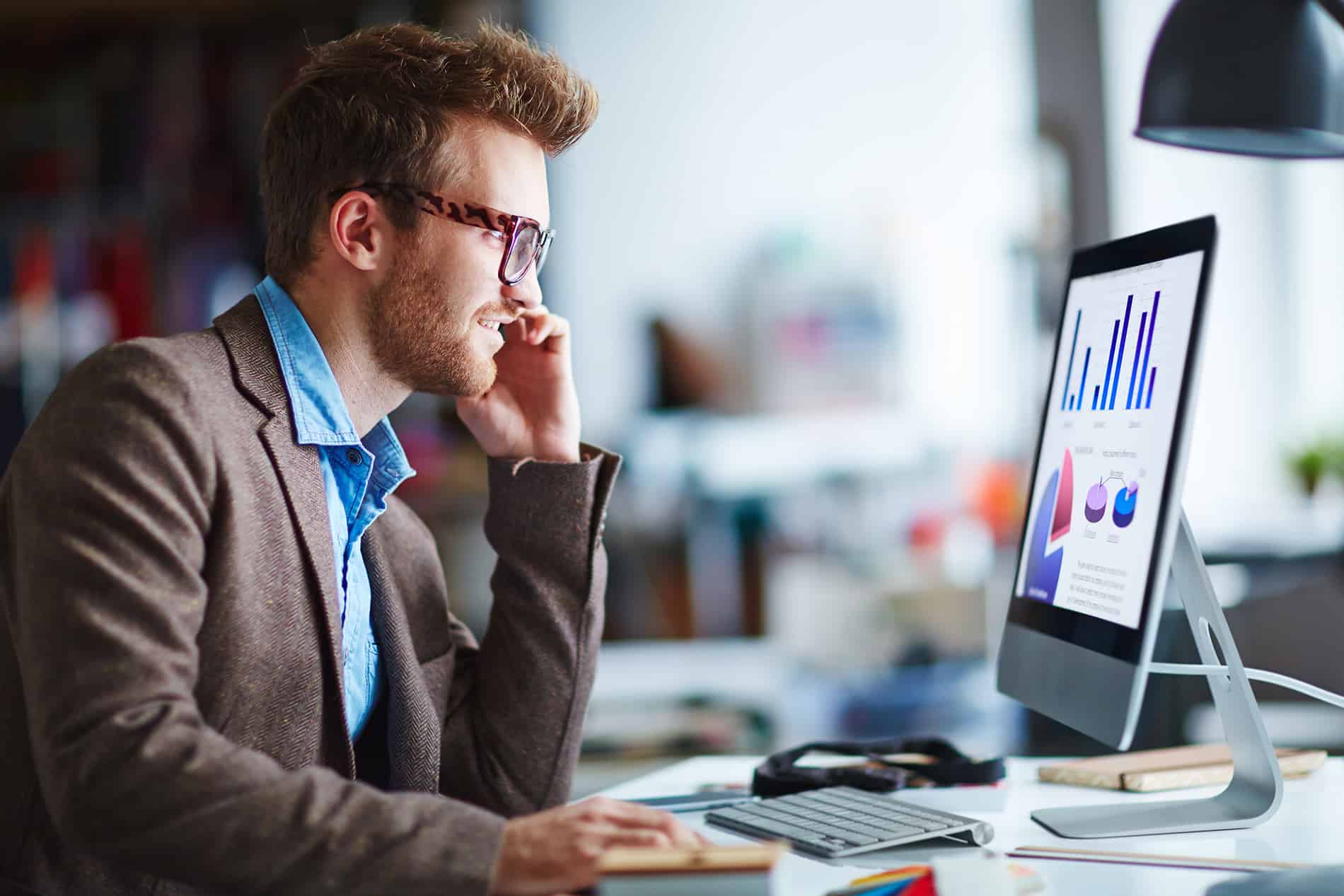

Your Web-Based Solution for Interest Rate Risk, Peer Analysis, and Forecasting

Take Your Community Bank to the Next Level

Call Report

Driven

Web-Based,

No Software to Install

Run Unlimited

“What-If” Stress

Scenarios

See Immediate

Results, Make

Better Decisions

Other products are keeping you from the analysis you need

Limited Software Access

Charge Fees for What-If Scenarios

Don't Offer Relevant Peer Analysis

BankersGPS is the trusted solution for more than 1,000 community banks

Access Anytime, Anywhere with our Web-Based Platform

Automatically updated quarterly with Call Report Data

Test Unlimited Scenarios with No Additional Costs

Built by Asset Liability Management Experts

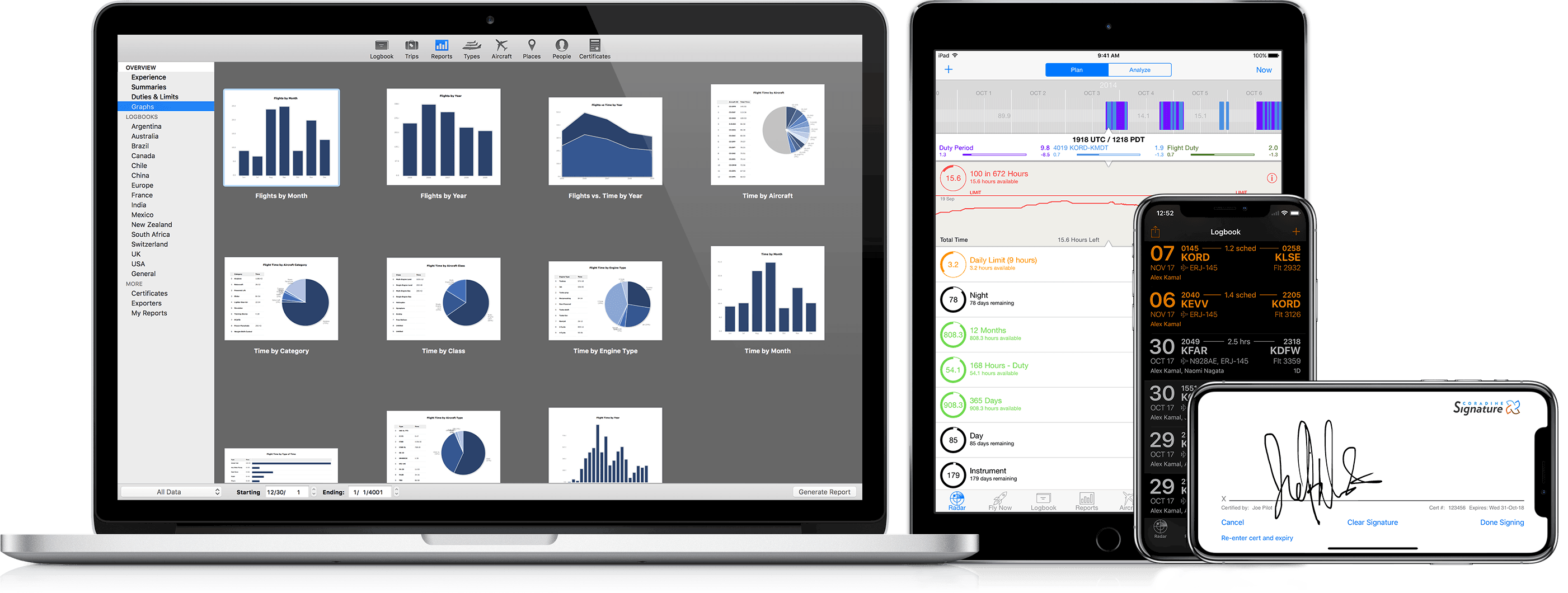

BankersGPS has four unique modules

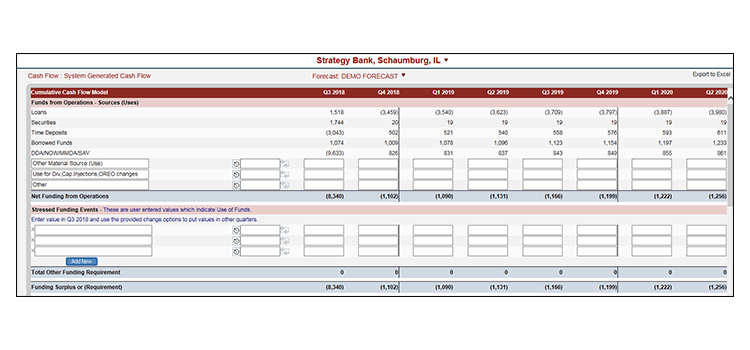

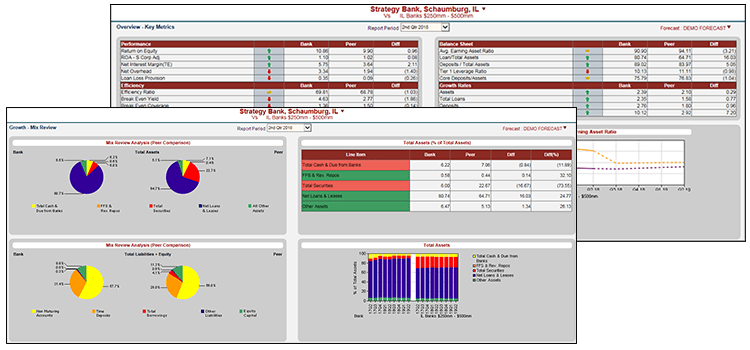

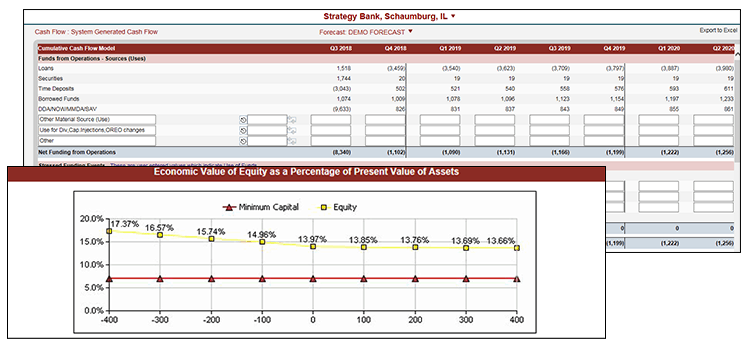

Forecast

Automate balance sheet and income statement forecasting for the next 3 years. Generate future performance ratios, liquidity/cash flow modeling, sources and uses, and loan stress testing.

Competitive

Create unlimited custom peer groups with

key metrics from any bank in the country. See Best-in-Class performance, loan quality, yield and cost data, and capital comparisons.

Risk

Easily model EVE and NIM at required rate shock levels, time periods, and yield curve shifts. Quickly customize your bank’s assumptions to produce a full IRR report with graphics and narrative that’s easy to understand and explain to Examiners.

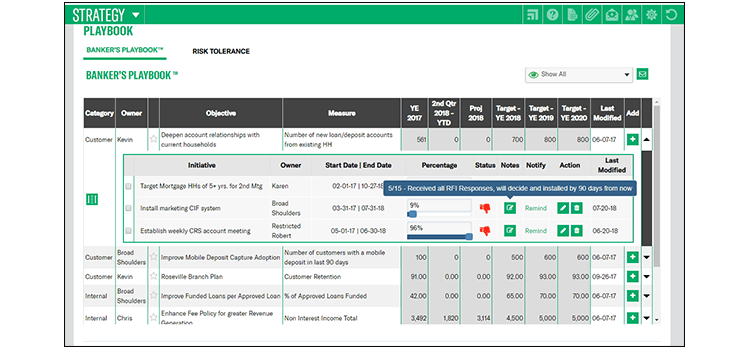

Strategy

Everything you need to build, track, and execute a winning strategy.

Ready to see it for yourself?

Schedule a discovery call today to get a personalized demo of BankersGPS

Implement BankersGPS

Compete, Earn, and Grow in the Market

Download Your Free Guide: What Examiners are Looking for Interest Rate Risk Management

Products

Contact

1827 Walden Office Square, Ste. 350

Schaumburg IL 60173

Toll Free: 1.800.323.3281

Local: 1.847.359.4045

Fax: 1.847.705.8200

info@plansmith.com

Account Projections Overview (9:14)

Learn how this screen allows you to model the growth, pricing, income and expense of the Balance Sheet and Income Statement.

Forecasting Overview (13:42)

Forecasting: Applying Manual Edits and Growth Models to the Balance Sheet

https://youtu.be/NrWRbnM65MU

Forecast Editing Tools (11:49)

The Quick Edit feature provides great power with several shortcut and calculation aides

Forecasting Webinar (57:32)

This 57-minute webinar reviews the different types of growth models, how to forecast using these growth models, and methods for forecasting non-interest income and non-interest expense.

Pricing Models Overview (11:20)

Learn how to link Interest Rates to the Yield Curve with spreads, floors & ceilings.

Pricing Models Webinar (1:17:45)

View this 77-minute session to learn about the essential components of pricing models, creating assumptions, and the application of pricing models in rate shock and budgeting.

Prepayment Utility (28:30)

Learn how Compass captures the financial instution’s specific prepayment experience and allows both simple and complex

prepayment modeling at the account or category level.

Rounding Out Your Assumptions Webinar (1:05:49)

View this 65-minute session to learn how Optionality is addressed in Compass through the Put/Call Feature and Prepayment Modeling. Understand the application of Decay and Alternate Discount Rates on Non-maturing Deposits (NMD). Review the input and functionality of Taxes and Dividends within the model.

Best Budgeting Practices (25:50)

This 26-minute webinar reviews best practice techniques for creating your annual budget and locking your budget for the new year.

https://youtu.be/02BH_rAVtN0

Suspend Auto Reforecasting During Budget Approval (10:45)

Learn how to suspend auto

https://youtu.be/Ogyrp_nSMFM

Locking the Budget (6:33)

Learn how to use the Lock Budget feature to transfer the projections into the Budget Tab.

https://youtu.be/13_yuOAYe-8

Year-End Shift (8:21)

This tutorial reviews the process referred to as shifting the database which is necessary to accommodate projected data for a new 12-month period by moving the prior year’s actual data and storing it as history

https://youtu.be/5wqkHnVGELk