Make CECL Easy with Our Automated, Affordable Solution

Plansmith has your affordable, easy button for CECL

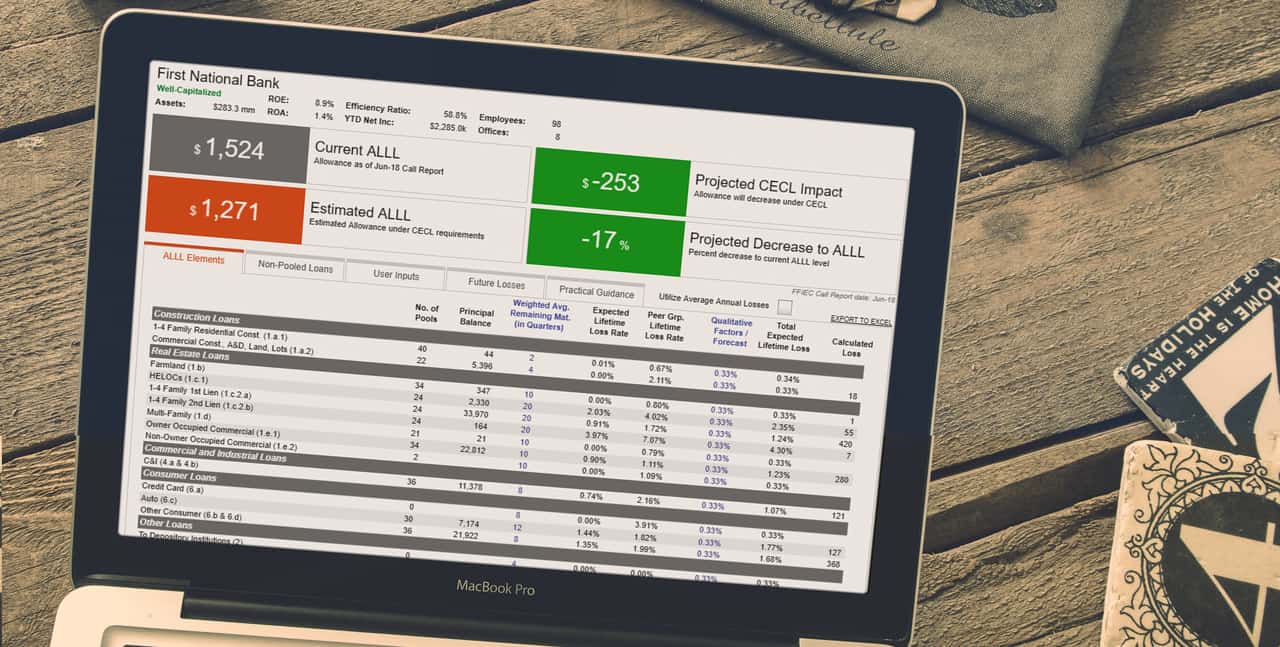

Uses Weighted Average Remaining Maturity (WARM) Method

Leverages Your Historical Call/5300 Report Data

Computes Loss Allowances Under Current or Future CECL Environments

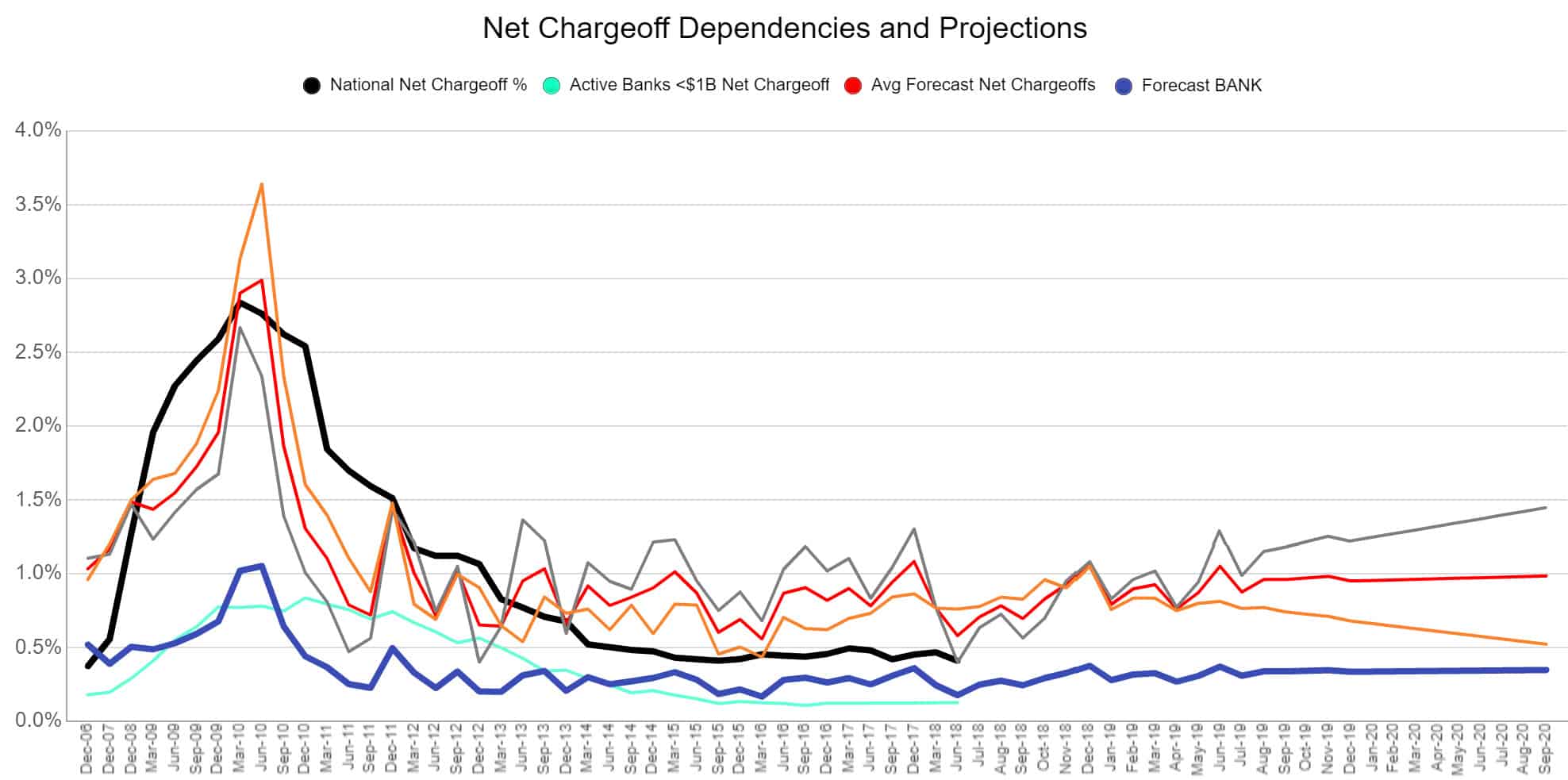

Automated Peer Group Analysis Provides Loss Rate Comparisons

Web-Based Platform Requires No Software or Core Integration

Other CECL Solutions Are:

Difficult to Implement

Outrageously Expensive

Frustrating to Use

Leverage the CECL Companion to further automate the process:

Generate the required User Inputs for Plansmith’s BankTrends CECL Calculator

Calculate Loan Principal Payments on an

Instrument Level Basis

Calculate Weighted Average Remaining Maturity (in Quarters), Weighted Average Interest Rate, and Annual Prepayment Assumptions for each Call Code Category.

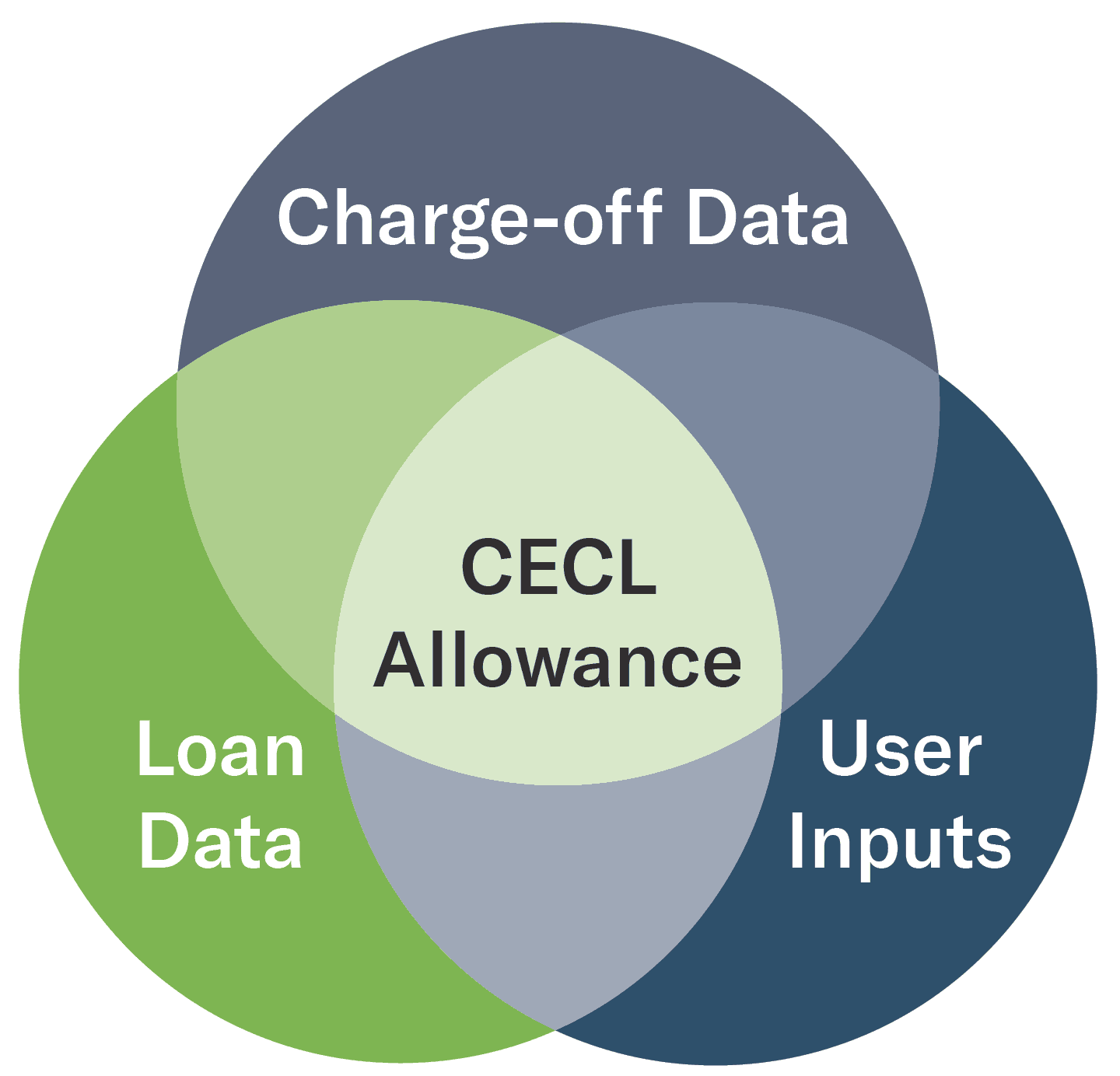

What Makes Plansmith’s Solution So Easy and Affordable?

Keep Your CECL Solution Simple!

Our Call Report based methodology is

consistent with recent regulatory guidance and utilizes the weighted-average remaining maturity (WARM) method for historical loss rate computations.

consistent with recent regulatory guidance and utilizes the weighted-average remaining maturity (WARM) method for historical loss rate computations.

Easily select the relevant historical

data which most closely resembles the

condition of your current loan portfolio.

data which most closely resembles the

condition of your current loan portfolio.

BankTrends maintains your historically submitted regulatory filings and utilizes that information to build historical portfolio loss rates going back over 11 years. This loss information is then aggregated with user input assumptions from your current interest rate risk model to forecast future estimated portfolio losses.

Ready to see it for yourself?

Schedule a discovery call today to get a personalized demo of Plansmith’s CECL Solution

Schedule a discovery call today to get a personalized demo of Plansmith’s CECL Solution

Receive a personalized demo

Implement & Streamline Your Allowance for Credit Loss Calculation

Be Prepared for Compliance with CECL

Products

Contact

1827 Walden Office Square, Ste. 350

Schaumburg IL 60173

Toll Free: 1.800.323.3281

Local: 1.847.359.4045

Fax: 1.847.705.8200

info@plansmith.com