Bring your budget to life and lead your team into the future.

You know your financial targets, but does everyone

know what they have to do to hit them?

A budget without a Playbook is just numbers on a page.

Budget Playbook is an Online Tool That Helps You Reach Your Budget Goals

Align Your Budget to an Action Plan

Quickly Update Your Team

Hit Your Targets

and Stay On Track

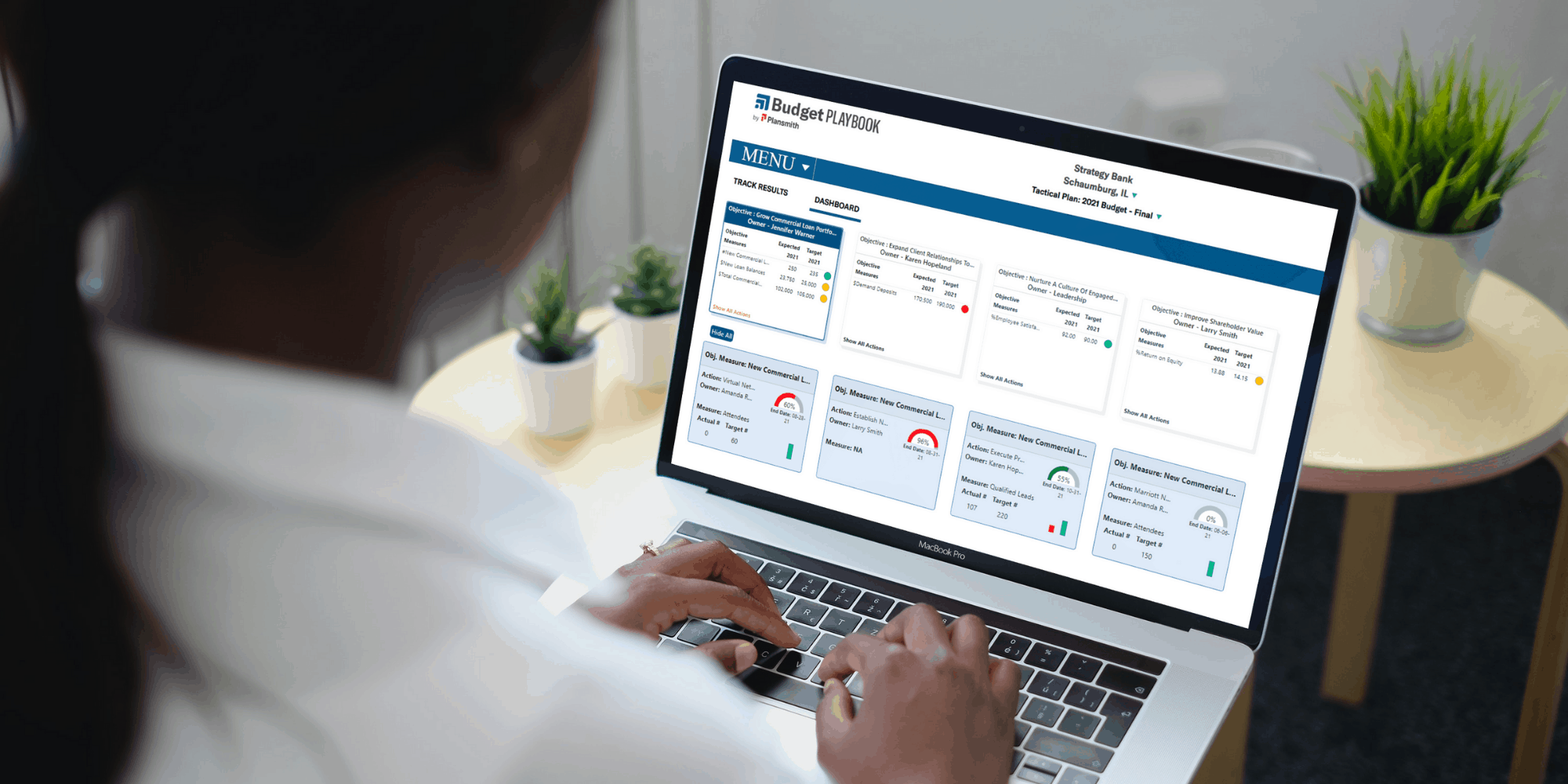

Use Dashboards

to Tell the Story

The Game Plan You Need to Execute Your Vision.

Stay on Track with Dashboards and Timeline Charts

that bring your whole plan to life!

Dashboard

The Dashboard quickly shows if projects are on track. Traffic-light symbols draw attention to successful action items and those at risk of falling behind.

Timeline Chart

The Gantt chart displays the flow of activities in your plan. You’ll quickly see if your action steps are appropriately sequenced and realistic based on current workloads.

Plus, other features help you…

Collaborate

Budget Playbook engages your team to creatively identify and execute the Objectives and Action Plans needed to hit your targets.

Objectives add focus while Action Plans layout the specific activities to

achieve them.

Empower

Assigning responsibility to Action Plans empowers the owner to set reasonable timelines and success measures.

Automated emails alert your team when it’s time for a status update. A single ‘click’ lets them report their progress without even logging in – fast and easy!

Execute

Budget Playbook’s blend of big picture and detailed views supports confident decisions and steady progress to your goals.

Everyone knows where to go and how to get there.

Improve Communication

Company-wide results and progress notes can be reviewed ahead of time. Meetings are streamlined and focused on constructive discussion.

You’ll achieve better communication, better team engagement,

and better results.

Watch a 2-Minute Video to See How Budget Playbook

Helps You Execute Your Budget.

Ready to Create A Game Plan to Reach Your Budget Targets?

Getting Started is Easy!

Receive a Personalized Demo

Start Using Budget Playbook

Execute Your Vision

Products

Contact

1827 Walden Office Square, Ste. 350

Schaumburg IL 60173

Toll Free: 1.800.323.3281

Local: 1.847.359.4045

Fax: 1.847.705.8200

info@plansmith.com